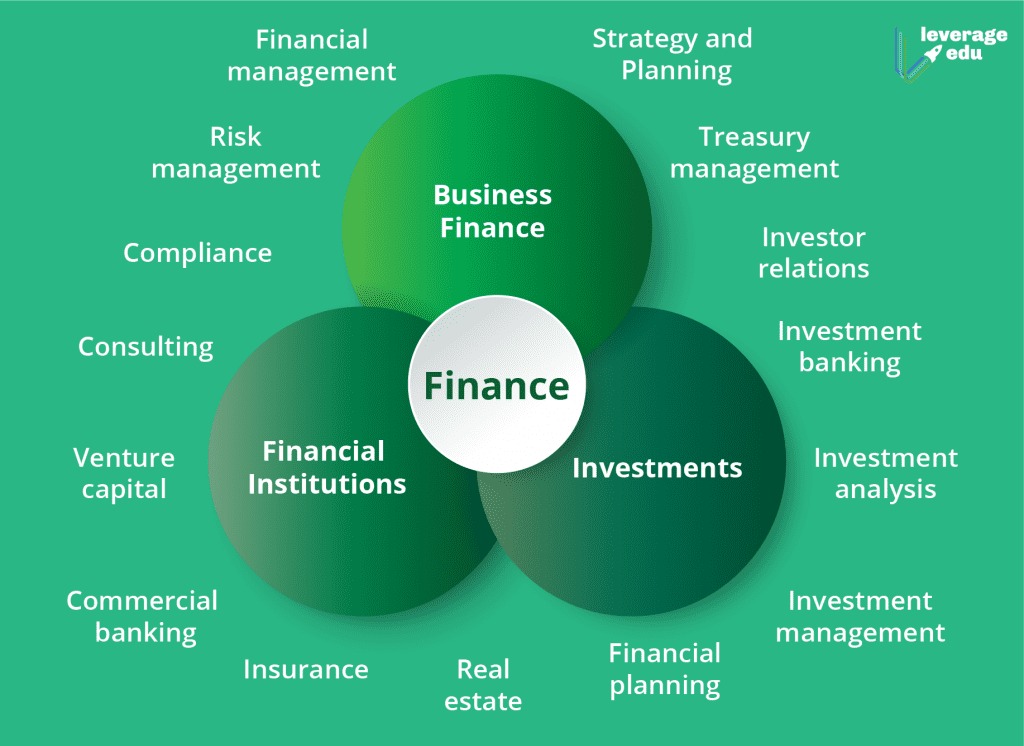

You’ve probably heard the term “financial product” before, but what exactly is it? Generally speaking, a financial product is anything that allows you to borrow, save, or invest money. This is different from a security, such as stocks or bonds, which are derivatives. A financial product is a contract with a company that allows you to make investments. The process usually involves many stages, including initial concept development, market analysis, product documentation, internal support, regulatory registration, and a full-scale market launch.

In the financial industry, there are different types of financial products, and there are strict federal rules regarding advertising. There are also FTC guidelines regarding credit issues. Some recent innovations in financial services include hedge funds, private equity, weather derivatives, retail-structured products, exchange-traded funds, multifamily offices, and Islamic bonds. Marketing for financial services is an important and complex process, because each product is similar to another. Therefore, financial products must be differentiated from other products in order to attract and retain clients.

A financial product can be created for use by the public, or it can be created for use by employees. Financial products may include credit cards, bank accounts, and investment goods. To create and launch a financial product, teams must first do a full cost-benefit analysis and determine feasibility. They must also create a vision for the product, and hire staff. Then, they must promote the new product to increase its sales.

In recent years, the FSRA has revised its definition of what constitutes financial product advice. It will now be deemed as advice if it is made as a recommendation, or it contains a statement of opinion. By introducing the new definition, financial product advice is no longer limited to advice. It will be considered an advice if it is made by a financial product expert. It can also include information provided by the consumer.