What is the difference between a bank and a finance company? Both provide loans to individuals and businesses, but the difference between a bank and a finance company is that banks have higher regulation. A finance company can lend you cash without a check or deposit account and does not require a cash deposit. They make their money by charging interest rates, which are generally higher than banks’. A finance company can help you make large purchases, such as a car or a home, but is not a bank.

Banks are privately-owned institutions. They provide a variety of financial services, including gauging interest rates and ensuring deposits are secure. However, the difference between a bank and a finance company lies in the types of loans they offer. Banks are typically the main source of consumer loans and are the primary lender of businesses. However, they are not the same. If you want to apply for a loan, you should make sure the bank has a good reputation and that the institution you are looking to borrow money from has a good history.

While banks are required to be government-chartered, non-banking financial companies (NBFC) are privately-owned, but offer similar services. They can’t issue demand drafts or cheques, but both operate in the public sector, whereas non-bank financial companies are private and not part of the payment system. NBFCs are often viewed as competitors of banks. However, NBFCs complement banks in various ways.

A bank makes its money from interest on the securities it holds and from fees for financial counseling and sales of other financial products. Generally, banks earn over 1% of their assets each year, and this is often referred to as return on assets, or ROA. The profit margin between banks and financial services is similar. While banks earn more revenue, financial services are paid from a variety of sources. These include fees and commissions.

A finance company isn’t subject to the same regulatory scrutiny as a bank, but they are more lenient on credit risk. Because they don’t rely on deposits, they are more willing to lend money to borrowers with higher risk profiles. A finance company’s overhead is typically lower than that of a commercial bank. They can be a good choice for a business loan. In fact, more than 50% of loans given to businesses are from finance companies.

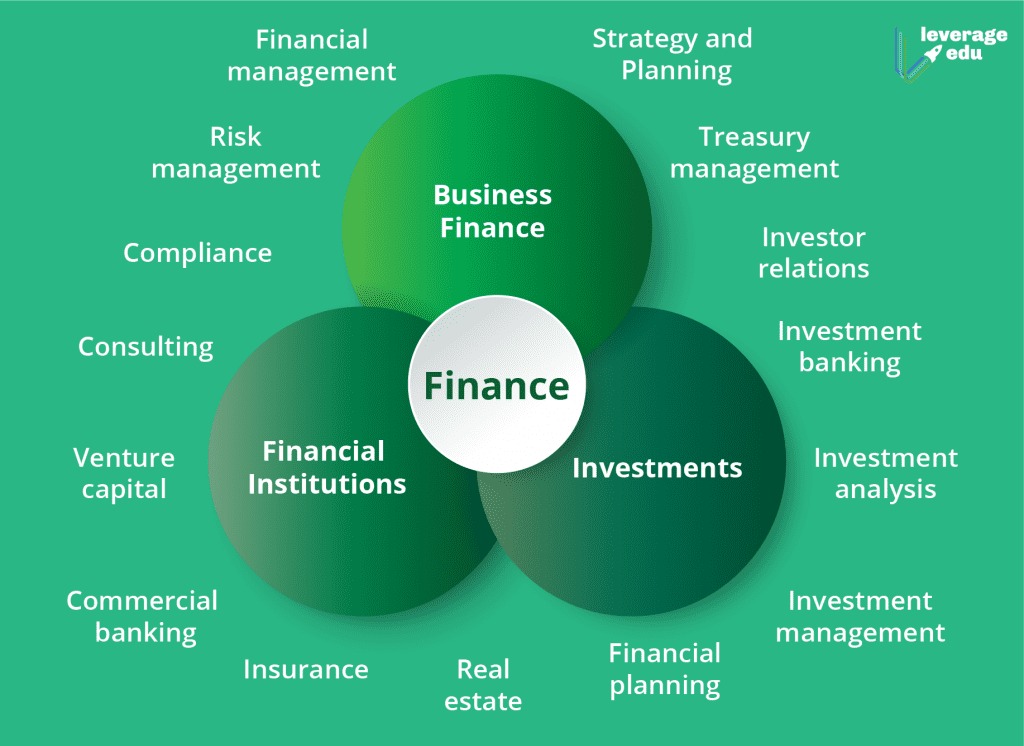

While most people tend to use the two terms interchangeably, there are important differences. Banks provide various services to help investors manage their wealth. Financial services firms provide a wider range of services than banks. While both types of institutions provide financial services, banks are more regulated, while finance companies provide a more diverse range of products. A finance company offers a broader variety of services, such as lending money to companies.

While banks are government-issued institutions, credit unions are not. They belong to the federal Bank Insurance Fund and serve a broader economic purpose. For example, governments issue bank charters to encourage different types of lending and promote local economic development. Using banks to serve economic policy goals requires a constant balancing act between community needs and the needs of the bank. Ultimately, banks fail when they don’t meet the community’s needs.

Both types of financial institutions exist to serve their customers. A bank, on the other hand, is a for-profit institution owned by shareholders, while an NBFC is a non-profit organization. The shareholders of a bank’s stock are known as stockholders. These stockholders have no voting rights and the bank’s board members are chosen by its current directors. Furthermore, the directors of a bank are not representative of its customer base. Despite these differences, banks still play an important role in economic development.

While they provide similar products, a credit union has its own unique set of characteristics. Credit unions are nonprofit and are based locally, while banks are owned and operated by private shareholders. They can be used for both personal and business banking. And while they offer similar services, a credit union is more local and has a stronger reputation in its community. If you are unsure about which type of financial institution will be best for you, we recommend comparing the different types of financial institutions before making a final decision.