Depending on your schedule and goals, you may not be able to attend classes in person. Choosing the right method of learning can help you achieve your goals. Make sure to choose a learning method that suits your lifestyle, and keep in mind your budget as well. You can take an online course or enrol in an in-person finance class. These options allow you to study anytime and anywhere. These programs are suitable for both beginners and those who are looking for a career change.

Financial literacy is the skill of understanding a range of financial skills. Financial literacy is crucial for avoiding high levels of debt and ensuring a secure retirement. Financial literacy encompasses basic financial skills, such as budgeting and handling debt, as well as investment management and retirement planning. Learn how to manage your money, set and reach financial goals, and identify unethical financial practices. As a result, you can enjoy financial independence and feel empowered as you advance in your career.

Financial knowledge helps you make informed financial decisions, and decision-making skills enable you to compare costs and benefits and make sound decisions. These skills can help young people make the right choices about their finances, and plan for their financial futures. However, you should never become an expert in personal finance if you are unsure of the basics. You can start by learning about how money works, budgeting, investing, and banking.

The best way to learn financial modeling is to practice. You can practice by reading equity research reports. These will give you the background and examples to compare your results. You should then calculate your net present value per share and compare it to target prices and current share price. You should also practice financial modelling with other companies’ financial reports. In the end, practice is the key to success. There are many books on the topic of finance, including Corporate Finance For Dummies and Introduction to Finance. The Bloomberg Opinion columnist discusses markets and investing, business news, and other financial topics. Listen to the Financial Modelling Podcast to learn more about how mathematical models work.

Financial management is one of the most lucrative career options available today. There are over 60,000 entry-level positions in the finance field, and over 30,000 of them are paid over $95,000 a year. As financial management is essential to every business, there is a great deal of room for growth and job security. So, what should I learn first in finance?? And why not begin with an online course? If you have the time and money, it might be worth investing in a finance course!

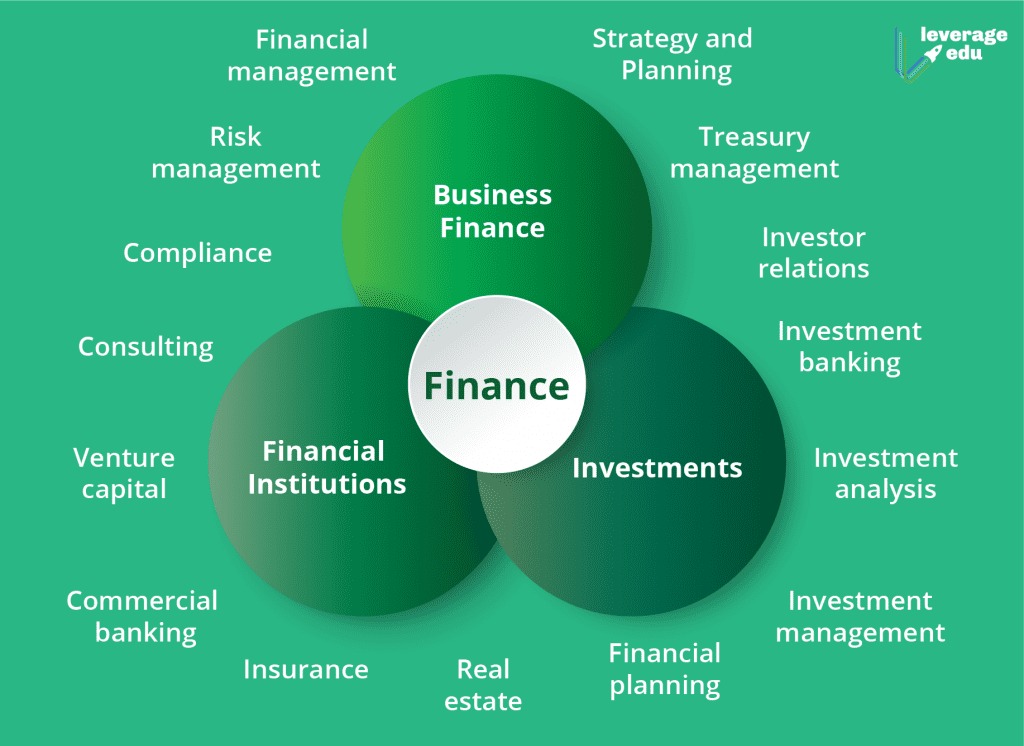

In business, finance departments are responsible for the collection, disbursement, and management of funds. It involves setting and analyzing budgets that align with the goals of the company. It also ties in with strategic planning, which involves setting a vision, mission, and short-term goals. With this knowledge, you can better manage cash flow and funds. Finance professionals keep the cash available to pay employees and maintain overhead expenses.

Choosing an online course to learn the basics of finance is a great way to gain experience and networking skills while earning a degree. A finance course is especially useful for aspiring professionals who want to start their careers in finance. You can even get a certificate or master’s degree from an online school if you’re interested. The choice is ultimately up to you, but getting a finance degree is essential.

Once you have a basic understanding of financial principles, you can choose to become a financial adviser. If you’ve always dreamed of working in finance, a finance degree can give you the skills you need to get there. Finance careers include hedge funds, investment firms, and the private sector. As such, it’s a great choice for anyone looking for an educational investment. The U.S. Bureau of Labor Statistics projects 8% growth in business and financial occupations through 2030.

Apart from the fundamentals, you should learn to budget. Budgeting is one of the most important money-management skills that a person can have. Many students are under the impression that student loans are the only option to pay for college. But there are many other sources of funding that don’t require repayment. For instance, there are other types of funding such as work-study options. These funding options should be explored.