Insurance is often described as a safety net for life’s uncertainties, yet for many people it remains a confusing subject filled with complicated terms and overwhelming choices. At its core, insurance is not as intimidating as it seems. It is a system designed to protect individuals, families, and even businesses from unexpected financial hardships. By paying a small regular amount known as a premium, you transfer the risk of large and unpredictable expenses to an insurance company. In return, the company promises to step in and help cover costs if something unfortunate happens. This exchange of risk for protection is the very heart of insurance.

To understand insurance clearly, it helps to think about everyday situations. Imagine you are driving to work and a car accident occurs. Without insurance, you would need to pay for repairs, medical bills, and possibly legal fees all on your own. With insurance, however, the company steps in and shares the burden, making an overwhelming situation more manageable. The same principle applies in health, life, home, and many other areas. Insurance does not prevent accidents or illnesses, but it cushions the financial blow when they arrive.

Insurance matters because life is unpredictable. Medical emergencies can strike at any age. Natural disasters can damage property in ways no one can foresee. Families may face the sudden loss of a loved one, and with that loss comes financial challenges. Insurance provides peace of mind by reducing the fear of “what if.” It ensures that when the unexpected does happen, you and your loved ones will not carry the full weight of the financial consequences.

One of the keys to understanding insurance is becoming familiar with the terms used. The contract between you and the insurance provider is called the policy. The regular payment you make is the premium. Coverage refers to the specific situations the insurer agrees to protect you against, while a claim is the request you file when you experience a covered event. Often, policies include deductibles, which is the amount you must pay yourself before insurance coverage begins, and exclusions, which are situations the policy does not cover. At first these terms may feel technical, but once you get used to them, comparing and choosing policies becomes much easier.

The way insurance works is based on a simple idea called risk pooling. Large groups of people pay premiums into a shared pool of money managed by the insurer. Not everyone will experience a loss at the same time, so the pooled funds can be used to help those who do. For example, thousands of homeowners may pay for insurance each year, but only a small number will actually face events like fires or floods. Because of the pool, the insurer can afford to pay those claims without collapsing financially. This principle ensures that the risk of one is spread among many, making protection affordable.

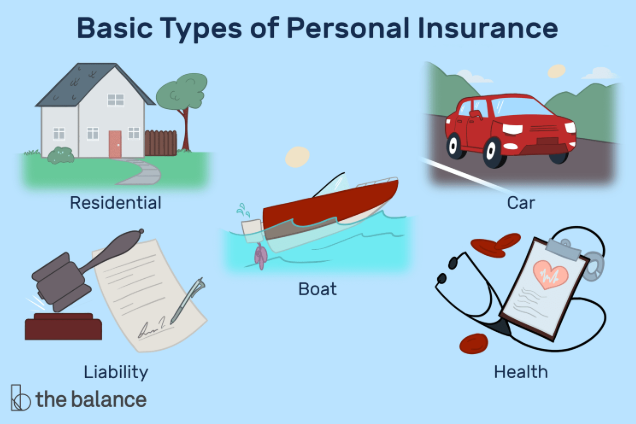

There are many types of insurance, but some are more common in everyday life. Health insurance is one of the most important, as it covers medical costs that could otherwise become overwhelming. From doctor visits and prescription medications to surgeries and hospital stays, health insurance makes healthcare accessible. Life insurance is another essential type, offering financial support to families when the insured person passes away. This ensures that dependents can still cover living expenses, pay debts, or continue their education even in the absence of the primary breadwinner.

Auto insurance is widely required by law in many countries. It covers expenses related to accidents, theft, or damage to vehicles and often includes liability protection if you cause harm to others. Homeowners and renters insurance protect living spaces and belongings. While homeowners insurance covers the structure of the house and its contents, renters insurance focuses on protecting personal belongings inside a rented apartment or house. Disability insurance is a less talked about but critical form, as it provides income replacement when illness or injury prevents someone from working. Another growing type is travel insurance, which covers trip cancellations, lost luggage, and medical emergencies while abroad, offering peace of mind during journeys.

Choosing the right insurance may feel overwhelming, but it becomes easier when you focus on your needs. A young professional may prioritize health and renters insurance, while a parent with dependents may look more closely at life and home protection. Comparing different providers and reading the fine print is essential to ensure you understand what is and is not covered. Cost is important, but the cheapest plan is not always the best. Often, paying a little more secures broader protection that can make all the difference in a crisis.

Many people avoid insurance because of myths and misconceptions. One common belief is that young and healthy individuals do not need coverage, but accidents and illnesses can happen to anyone, regardless of age. Another myth is that insurance is a waste of money because you may never use it. In reality, the purpose of insurance is not guaranteed usage but guaranteed protection if the unexpected strikes. It is similar to wearing a seatbelt; you may not need it every time you drive, but when you do, it could save your life. Another misunderstanding is that all policies cover everything. In truth, every policy has limitations and exclusions, which makes reading and understanding the terms very important.

Insurance also plays a critical role in financial planning. It ensures that savings and investments are not wiped out by sudden crises. A single hospital stay without health insurance could cost tens of thousands of dollars, undoing years of careful saving. With insurance, you protect your financial progress and give yourself the ability to keep building toward long-term goals such as buying a home, educating children, or preparing for retirement. In this sense, insurance is not just about protection; it is about enabling stability and growth.

Beyond personal finance, insurance reflects responsibility and contributes to the wider community. Car insurance ensures that accident victims are not left without support. Health insurance helps spread medical costs across society. Home insurance ensures that neighborhoods recover faster after disasters. By carrying insurance, individuals contribute to a safer and more stable system where everyone benefits.

The future of insurance is becoming more digital and customer-friendly. Companies are now offering mobile apps that allow users to file claims, check policies, or make payments instantly. Technology also allows for personalized premiums based on lifestyle. For instance, safe drivers may receive discounts on car insurance, while people who maintain healthy habits may pay less for health coverage. These innovations are making insurance more interactive and tailored to individual needs.

In conclusion, insurance is a powerful and necessary tool for modern life. It protects against unexpected events, offers peace of mind, and creates stability for both individuals and families. By understanding the basics—what insurance is, why it matters, how it works, and what types are available—you gain the confidence to make informed choices. Insurance is not just another bill; it is a foundation of financial well-being and a promise of security when life takes an unexpected turn. Investing time in learning about insurance today can save you from hardship tomorrow, making it one of the most important steps in building a stable future.